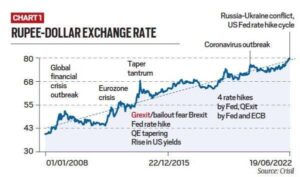

The Indian rupee breached the psychologically significant exchange rate level of 80 to a US dollar in early trade.

Free fall of Indian Rupee

- Since the war in Ukraine began, and crude oil prices started going up, the rupee has steadily lost value against the dollar.

- There are growing concerns about how a weaker rupee affects the broader economy.

- Certainly it presents challenges to policymakers, especially since India is already grappling with high inflation and weak growth.

What is the rupee exchange rate?

- The rupee’s exchange rate vis-à-vis the dollar is essentially the number of rupees one needs to buy $1.

- This is an important metric to buy not just US goods but also other goods and services (say crude oil) trade in which happens in US dollars.

| Benefits of Rupees fall

Broadly speaking, when the rupee depreciates, importing goods and service becomes costlier.

But if one is trying to export goods and services to other countries, especially to the US, India’s products become more competitive.

Depreciation makes these products cheaper for foreign buyers. |

How bad is it for the rupee?

If the rupee depreciates at a rate faster than the long-term average, it goes above the dotted line, and vice versa

While India is fine as of now, trends suggest things are getting worse. For instance, forex reserves have fallen by over $50 billion between September 2021 and now. |

It is important to remember that it is more of a story of the dollar strengthening than the rupee weakening.

This suggests that as things stand, India is still not facing an external crisis.

India’s vulnerability on the external debt front

- In 2021-22, India had a trade deficit of $189.5 billion.

- That is, the country imported more goods (such as crude oil) than it exported, and the net effect was negative.

- At the end of the year, the BoP was at a surplus of $47.5 billion — that is, the net effect of all transactions on current and capital accounts was that $47.5 billion came into India.

Now, two things can happen from here:

- Huge BoP surplus would lead to the rupee appreciating:

- This will bring about a change in people’s buying and investing preferences.

- For instance, India’s exports will become costlier and import cheaper. Over time, the trade deficit will alter (will reduce or turn into a surplus) to “balance” the BoP.

- RBI swoops in and removes all the surplus dollars:

- RBI purchases dollars to increase its forex reserves.

- In 2021-22, for instance, India’s forex reserves went up by $47.5 billion.

- The RBI keeps monitoring the BoP every week and keeps intervening in such a manner which ensures that the rupee’s exchange rate does not fluctuate too much.

What will be the effect on the economy?

- Since a large proportion of India’s imports are dollar-denominated, these imports will get costlier.

- Costlier imports, in turn, will widen the trade deficit as well as the current account deficit, which, in turn, will put pressure on the exchange rate.

- On the exports front, however, it is less straightforward.

- For one, in bilateral trade, the rupee has become stronger than many currencies.

What should policymakers do?

- The RBI (which is in charge of monetary policy) should focus on containing inflation, as it is legally mandated to do.

- The government (which is in charge of the fiscal policy) should contain its borrowings.

- Higher borrowings (fiscal deficit) by the government eat up domestic savings and force the rest of the economic agents to borrow from abroad.

READ MORE: Daily Prelims Booster

READ MORE: Daily News Analysis

Leave a Comment